8 Simple Techniques For Unicorn Financial Services

Wiki Article

Not known Facts About Refinance Broker Melbourne

Table of ContentsThe Main Principles Of Mortgage Broker Melbourne Get This Report on Melbourne BrokerMelbourne Broker - QuestionsMore About Mortgage Broker In MelbourneGetting The Unicorn Financial Services To Work

A professional home mortgage broker comes from, discusses, and also processes property and commercial mortgage on part of the customer. Below is a six factor overview to the services you ought to be provided and the expectations you should have of a professional home mortgage broker: A home loan broker provides a large range of mortgage from a number of different lenders.A home loan broker represents your passions as opposed to the rate of interests of a loan provider. They should act not only as your representative, however as a well-informed specialist and problem solver. With access to a large range of home mortgage products, a broker has the ability to provide you the biggest value in regards to interest rate, repayment quantities, and also lending products (refinance broker melbourne).

Several circumstances require greater than the simple use a thirty years, 15 year, or flexible price mortgage (ARM), so innovative home loan methods and also advanced solutions are the benefit of functioning with a seasoned mortgage broker (https://mexterlocallistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker browses the customer with any situation, managing the process and smoothing any type of bumps in the roadway along the way.

Consumers that locate they need bigger fundings than their financial institution will approve also gain from a broker's understanding and also capability to successfully acquire financing. With a mortgage broker, you just need one application, instead of completing types for each specific loan provider. Your home loan broker can give a formal comparison of any type of car loans recommended, leading you to the info that properly portrays cost distinctions, with current rates, points, and closing prices for each and every financing reflected.

Rumored Buzz on Broker Melbourne

A trustworthy mortgage broker will certainly divulge exactly how they are paid for their services, along with information the complete expenses for the lending. Individualized solution is the separating aspect when choosing a home mortgage broker. You should anticipate your mortgage broker to aid smooth the way, be readily available to you, as well as advise you throughout the closing process.

Working with a home mortgage broker can potentially conserve you time, effort, as well as money. A home mortgage broker may have better and a lot more access to lending institutions than you have.

Examine This Report about Refinance Broker Melbourne

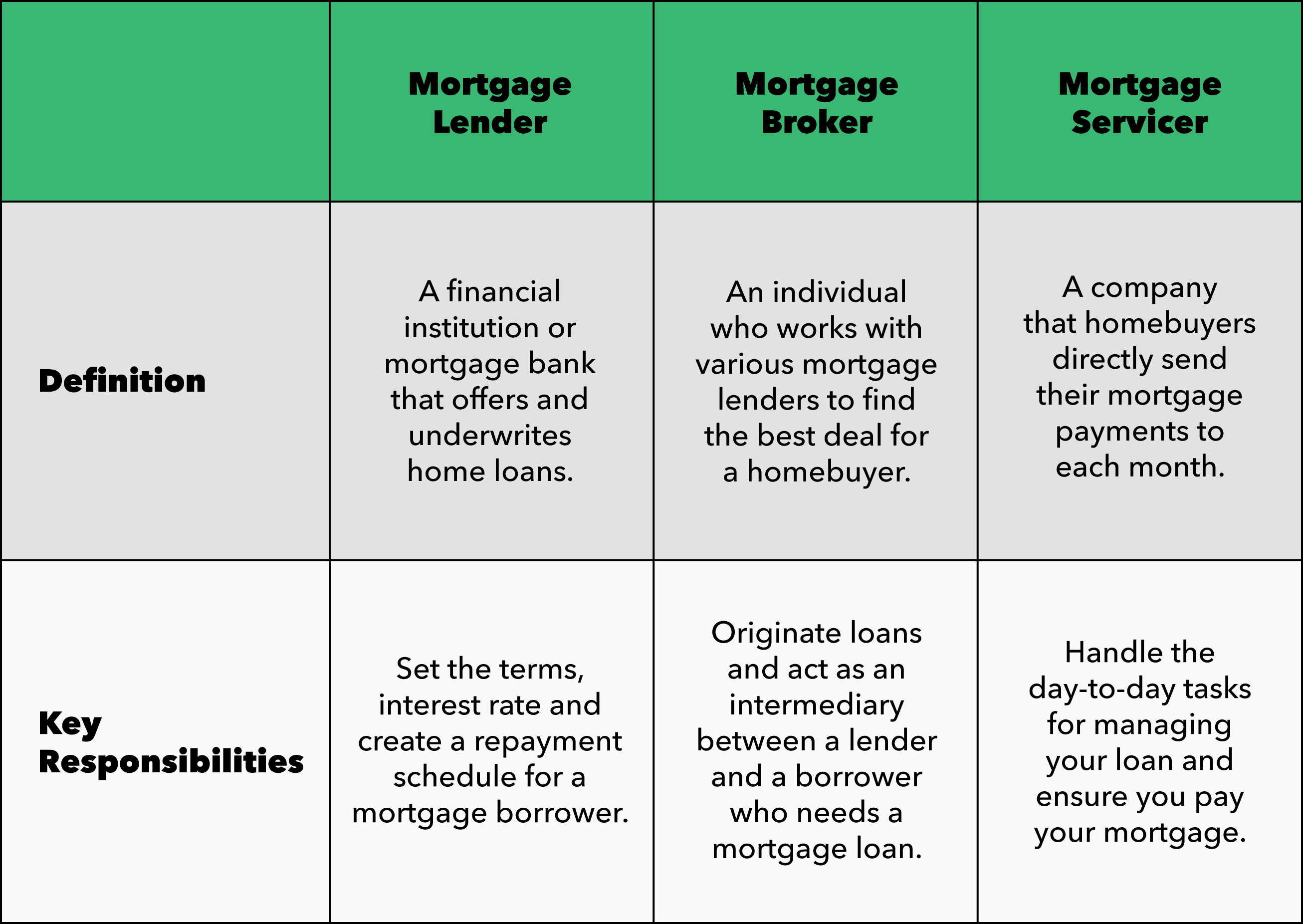

A mortgage broker does as arbitrator for a monetary establishment that provides finances that my site are secured with realty and also individuals that desire to acquire property and need a lending to do so. The mortgage broker deals with both consumer and loan provider to obtain the customer accepted for the funding.A home loan broker commonly works with several lending institutions and also can offer a range of loan alternatives to the customer (https://topcompanydirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A customer doesn't have to deal with a home loan broker. They can work straight with a loan provider if they so select. A loan provider is a banks (or individual) that can offer the funds for the property transaction.

A lending institution can be a financial institution, a lending institution, or other monetary venture. Possible house customers can go straight to any type of lending institution for a loan. While a home mortgage broker isn't needed to facilitate the purchase, some lending institutions might just resolve home loan brokers. So if the lender you like is amongst those, you'll need to utilize a home loan broker.

They're the individual that you'll take care of if you come close to a lender for a loan. The lending police officer can aid a customer comprehend as well as select from the financings used by the loan provider. They'll respond to all questions, aid a consumer obtain pre-qualified for a financing, and aid with the application process.

The Buzz on Refinance Melbourne

Home mortgage brokers don't give the funds for car loans or approve lending applications. They assist people looking for mortgage to find a lending institution that can fund their home purchase. Start by making certain you understand what a mortgage broker does. Ask good friends, loved ones, as well as organization associates for references. Have a look at online evaluations as well as check for problems.Ask about their experience, the precise help that they'll offer, the charges they bill, and exactly how they're paid (by lender or debtor). Ask whether they can assist you in particular, given your specific economic conditions.

Encountered with the predicament of whether or not to use a mortgage broker or a loan provider from a financial institution? Well, we are right here to tell you, don't run to the bank! It's absolutely nothing individual. We like banksfor points like saving and spending money. When you are looking to buy a residence, nonetheless, there are 4 key elements that mortgage brokers can offer you that the loan providers at the bank simply can not.

At Eagle Home mortgage Business, personal touch is something we pride ourselves in. You obtain to work with one of our representatives directly, who has years of experience and can answer any kind of inquiries you might have.

The Ultimate Guide To Mortgage Broker In Melbourne

Their hours of procedure are usually while you're already at work. Get the personal touch you are entitled to with a mortgage broker that cares! The adaptability a home loan broker can use you is simply another reason to prevent going to the financial institution.

Report this wiki page